Equipment delivery in the oil industry hasn’t changed much over the decade I have been working in and around it. As a Project Manager for a major OEM delivering new build projects, the variables in manufacturing were general and standard for the most part. My equipment deliverables were similar with only various iterations, adjustments, or upgrades depending on drilling field requirements or specs for the rig. Major pain points were typically integrations of our equipment once in shipyards or small, unforeseen variations that may have been missed thus compounding problems at delivery.

As the industry came to a screeching halt in 2014 with oil at $40 a barrel, something had to change about how the oil industry was doing business.

The industry had to adapt to oil at that value by approaching execution strategies, client sales, and revenue generating business models in a different way.

Besides the initial build, the Special Periodic Survey (SPS) is one of the most costly events a rig experiences in its lifetime, typically taking place at a rig or equipment’s 5/10 year life. Most offshore vessels, to stay on contract, needed some sort of equipment survey to re-certify the equipment being used or for heavy maintenance that may have been pushed off.

During the SPS, a rig is taken offline and docked in a shipyard for a few weeks or months depending on the rigs’ SPS scope. These rigs spend an exorbitant amount of money not only to perform these SPS scopes and during this time they are not generating any revenue. So, in 2014, rig owners/operations needed to find a new execution strategy to keep their rig online generating cash, but still perform an SPS scopes to gain certification.

This led the oil industry to turn to other industries for ideas.

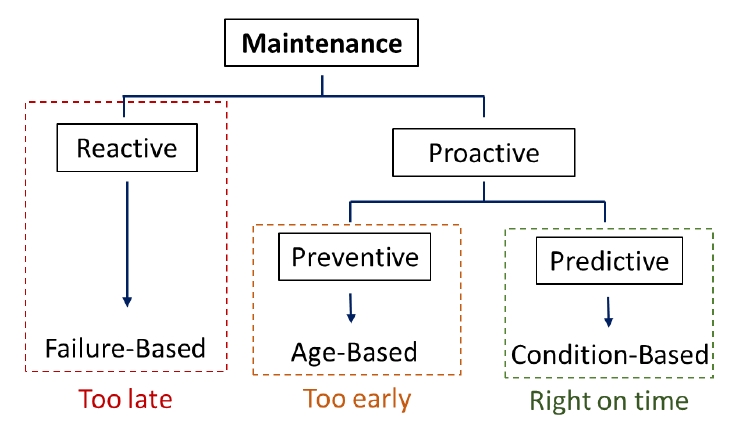

Insights were gleaned from the airline industry where the use of Condition Based Maintenance and Condition Monitoring is prevalent. The philosophy behind this is simple. Instead of old calendar based maintenance, work/maintenance will be actioned based on condition. If it isn’t broken, don’t fix it. For a plane, if a part is about to break that is critical or could be catastrophic, data is used to understand and monitor condition so preventative maintenance may be carried out before the plane takes off again.

Courtesy of EXSYN Aviation Solutions

This works well for the airline industry as they have large areas of land to keep parts, hangers, and facilities to work on aircraft. Planes also land every few hours and can be taken offline easily. When a plane is offline there is enough air traffic to find additional seats or routes to offset potential revenue losses.

However, in the offshore oil industry, if something catastrophic breaks or goes down on the rig in the middle of the ocean, that asset cannot be repaired unless the needed part is inventoried. If not, the part or personnel who is best qualified to fix the issue may be onshore taking hours or days just to get to the rig via helicopter. If the rig cannot commence operations because of the problem they are not making money.

The oil industry is now diving head first into data driven condition based solutions. Instead of a typical costly SPS where the rig isn’t generating revenue, the industry is staying alive by keeping rigs working on contract and taking the rig offline only if indicators are showing an imminent failure or equipment performance is diminishing. This allows for continuous operations and more logically timed preventative maintenance moving away from calendar based decisions.

Collaborations are starting to crop up between OEMs and Drilling Contractors where both companies aim to benefit in the singular goal of lowering the total cost of equipment ownership while extending the equipment life. Through these partnerships, the best possible decisions given an equipment’s condition can be derived given its original design, how it’s being used, and environmental variables that may affect its longevity.

Through these partnerships, the oil industry will see a significant wave of modifications to drilling tools making them easier to maintain and access. Additionally, the customer’s cost of ownership and equipment downtime is improved while keeping the rig operating and away from the costly shipyard SPS.